A Small Solution To A BIG Problem

If you've ever been turned down for car credit, then you'll know just how much an inconvenience it really is.

“I had almost given up on getting car finance but I thought I would make one last try and went to Accept Car Credit. I dealt with Neil and I have to say the service was first class and within 10 days I had my new car. I am a very happy customer.”

User DJC1966 from Review Centre

90% of users recommend us

Accept Car Credit is a Specialist Car Finance Lender

The Car You Want From The Dealer You Choose!

That’s the Accept Car Credit way.

Specialist responsible car finance lender for car loans to customers with a poor/bad credit history.

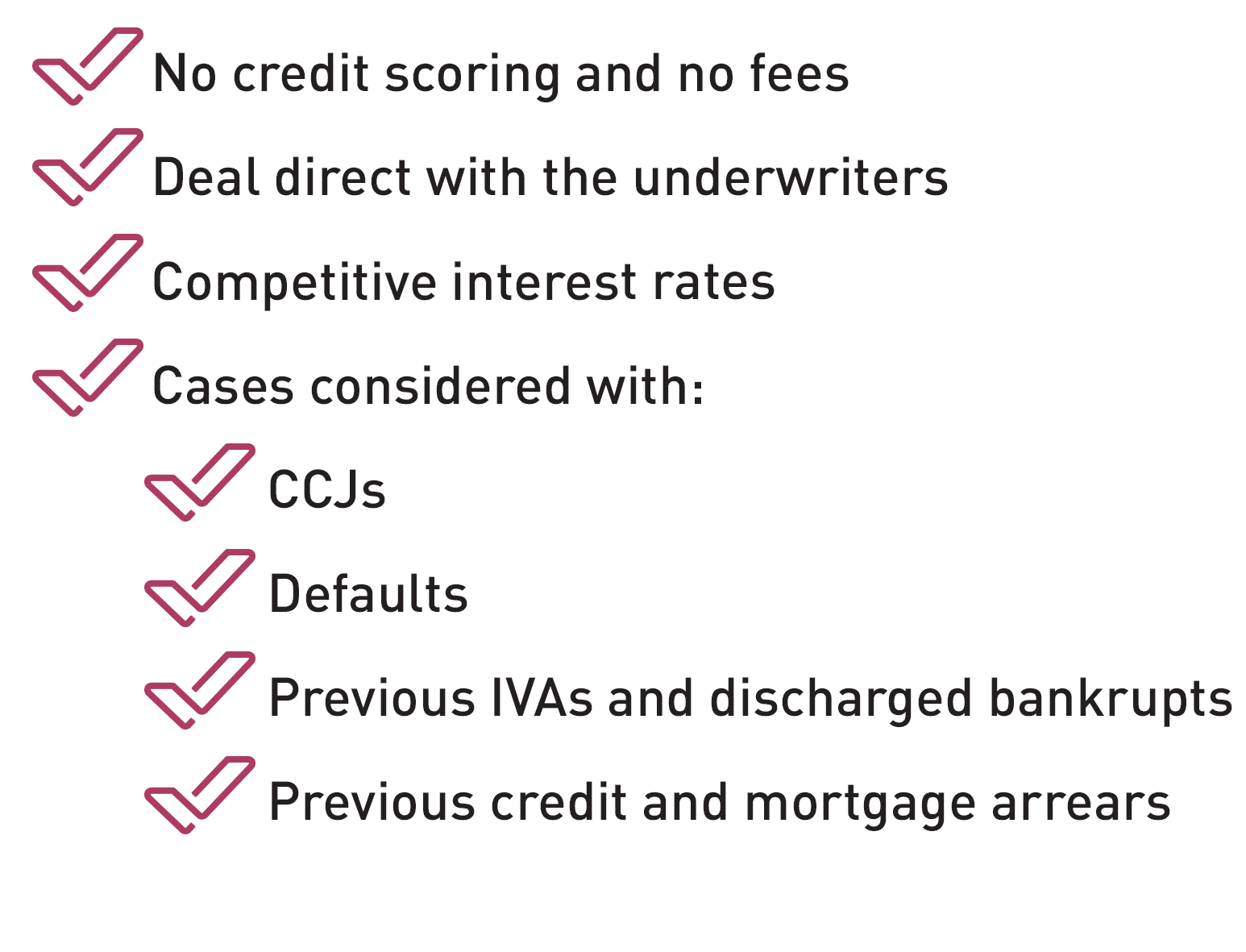

No credit scoring and no fees

Deal direct with the underwriters

Competitive interest rates

Cases considered with:

CCJs

Defaults

Previous IVAs and discharged bankrupts Previous credit and mortgage arrears

Accept Car Credit is a privately owned, family-run, bad credit car finance company with over 30 years’ experience in lending responsibly against the value of the Car / Light Commercial Vehicle. Due to the fact we only lend trade value we do require a minimum 20% deposit this does help in the future should you wish to sell or part exchange your car/van.

We’re authorised and regulated by the Financial Conduct Authority and the CCTA (Consumer Credit Trade Association) so you know you are in the safest of hands when you apply for Accept car finance.

Accept Car Credit is Quick, Simple and Stress-free!

Being without a car can be a huge hassle. From not being able to get to work or do the school-run to having to rely on public transport, the less time you’re without a vehicle the better!

With Accept Car Credit the time you spend without a car is kept to a minimum. The process of applying for car finance couldn’t be more seamless when you choose Accept Car Credit – no matter what your credit history.

You can become part of our solution!

Frequently Asked Questions

We are a Direct Lender

IMPORTANT Credit is subject to status, affordability and credit check

We are registered in England and Wales under company number 05264401.

Our registered office is at:

Accept Car Credit Limited, 2 Longroyde Close, Rastrick, Brighouse, West Yorkshire HD6 3UR

Accept Car Credit Limited is fully authorised by the Financial Conduct Authority from 3rd May 2016 - number FRN711589

Representative APR:29.9%

Loan Amount:£5,000

Loan Term:48 months

48 Monthly Repayments:£168.75

Annual Rate of Interest:29.9%

Total Amount Payable:£8,200

Suggested Representative

APR Example

29.9%

£5,000

48 months

£168.75

29.9%

£8,200